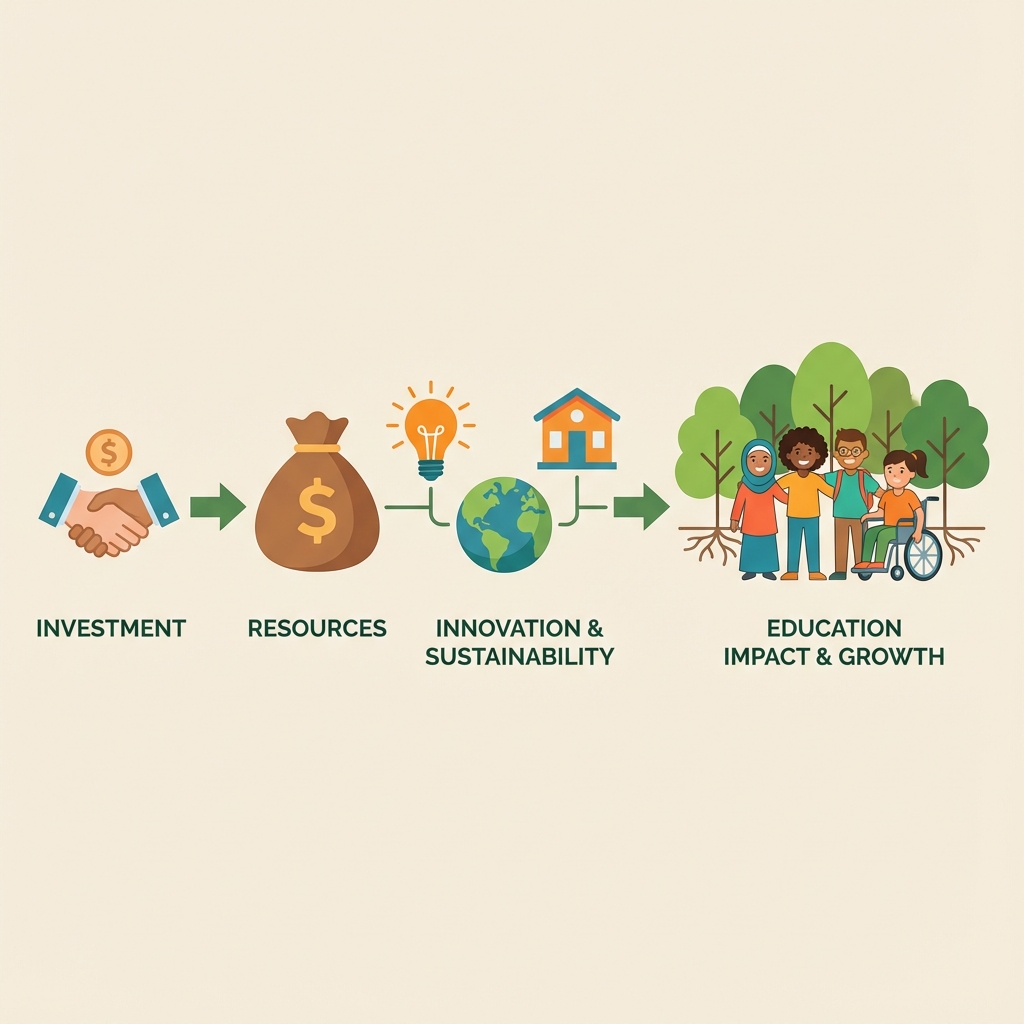

Impact investing refers to investments made with the intention to generate a measurable, beneficial social or environmental

impact alongside a financial return. Impact investments provide capital to address social and/or environmental issues.

Alumna connects impact investors to a sector which is experiencing huge challenges from a financial inclusion and capacity constraints perspective. All over the world students are struggling and standing up against historical exclusion from education due to socio economic factors. Impact investors could make a huge social impact in transforming this sector for better socio economic development in local and emerging economies while gaining a higher return on investment and creating a big social impact.

Impact investments are known to bring in returns that are competitive with the stock market. According to a study by the Global Impact Investing Network (GIIN), impact investments have average returns of 5.8% since their inception. The impact investment market is estimated at over 750 billion dollars in total size.

Alumna creates a platform to access an avenue towards the impact investing sector through global education markets.

The detailed flow and terms for project stakes are completely articulated in the terms of service when impact investors buy into projects and through the project stake owner agreement.

Impact investors buy stakes into the crowd sale projects which are featured on the Alumna platform. New crowd sale projects are always featured on the platform as earlier projects become sold or reach term of expiration.

After impact investors buy into project stakes their contributions are stored in 3rd party escrow accounts and nano wallets for secure and safe storage. They are stored until crowdsale projects are sold out or when the contributions reach the effective date to be transferred to beneficiaries (lessees) for usage of the digital asset.

Alumna's team and governance processes will be the control mechanism to make sure that impact investors get their rental payments (annuity income) when students become cash generating assets upon graduation.

It is decentralised technology that allows financial transactions between two participants in a secure, reliable and irreversible way, without having to go through intermediaries. The recorded data is impossible to modify and can not be deleted either, which makes the Blockchain itself safe against manipulation.

Ethereum is a decentralized global platform that enables one to write codes to control money and build applications accessible from anywhere. It allows developers to create operations based on their needs and build thousands of different applications, including smart contracts.

Ether is a digital asset bearer similar to a commodity and is the solution to the issue of payment. It functions like cash without requiring a third party for approving transactions. Ether is the fuel used to power the Ethereum network and enables operations on the blockchain.

A "SmartContract" is a software program that facilitates, ensures, enforces and executes agreements registered between parties. They assist in negotiating and defining agreements that will cause certain actions to occur as a result of specific conditions being met.

A new way of investing, favouring the financial inclusion of unbanked students around the world to contribute to socio economic growth and development.

BROWSE CROWD SALE PROJECTS